are 529 college savings plans tax deductible

If you live in Missouri and make a contribution to a MOST 529 Plan account then you can deduct the total MOST 529 Plan contributions for the. The Path2College 529 Plan is.

529 Plans 529 College Savings Plans What Is A 529 Plan

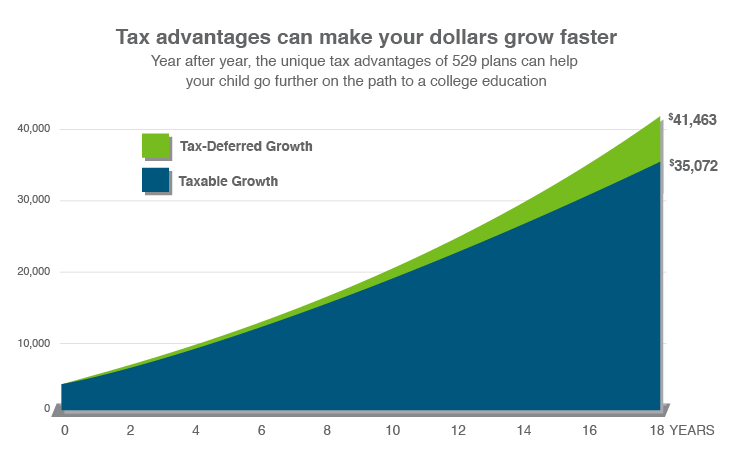

529 plan contributions arent typically tax-deductible but they are exempt from federal.

. Not all states allow for a tax deduction and there is no deduction for your federal tax bill. Check with your 529 plan or your state. Use our 529 State Tax Deduction Calculator to find out what benefits might be available to you.

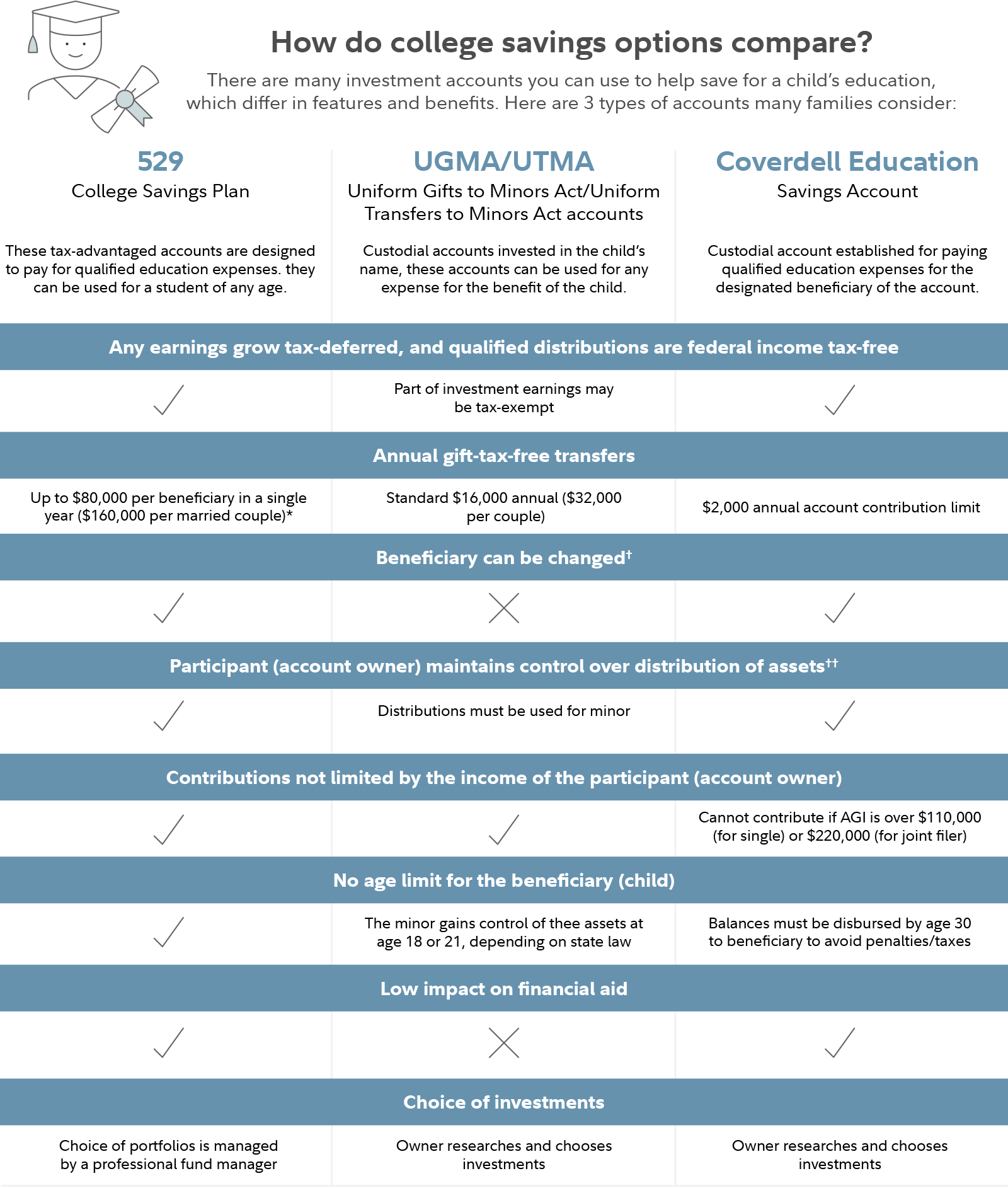

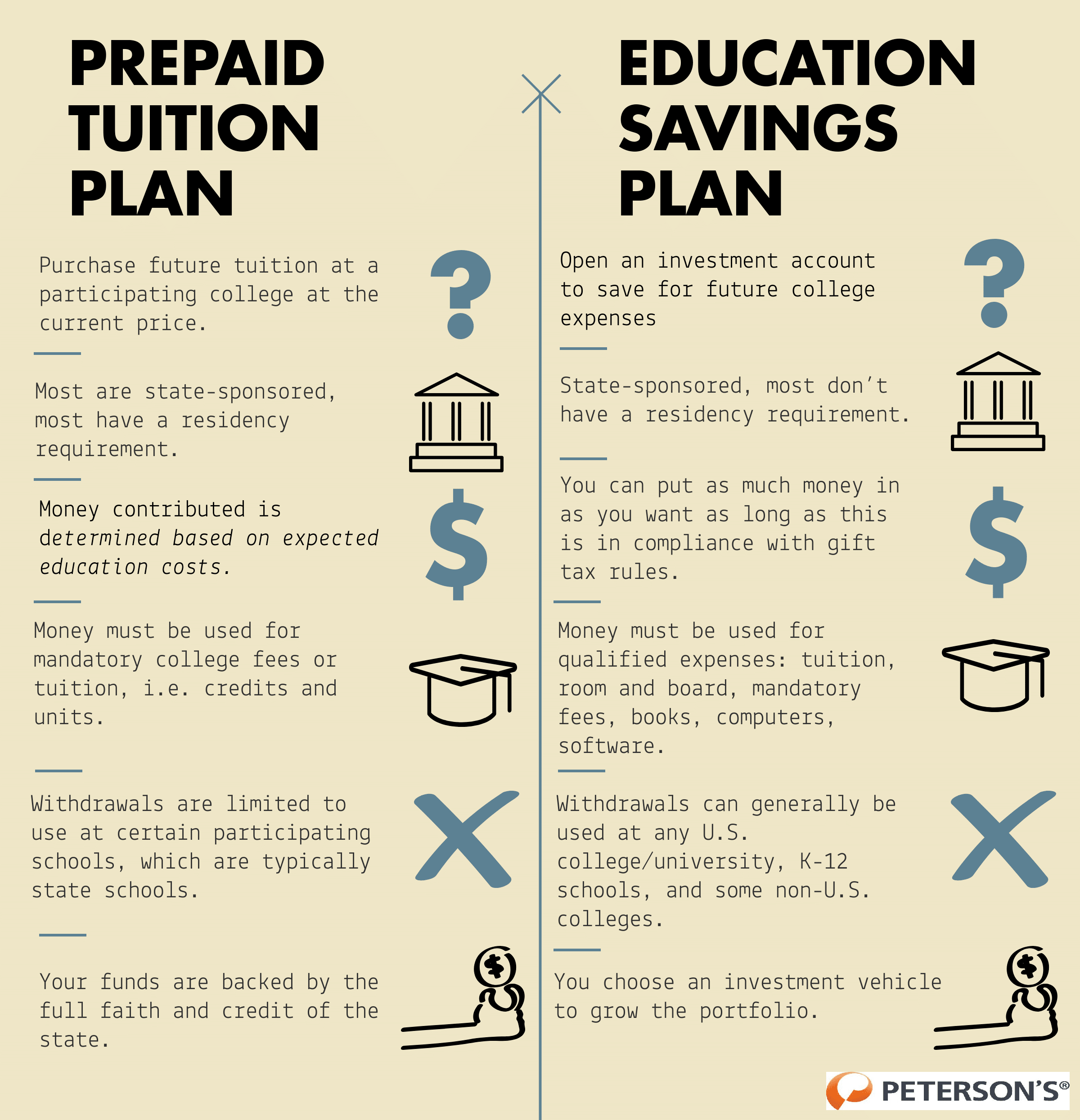

Where To File Taxes Online. A 529 a tax-advantaged savings plan or qualified tuition plan encourages saving for future education costs. Tax-Advantaged College Savings Plans.

NEBRASKA with the NEST Direct College Savings Plan taxpayers can deduct up to 10000 in contributions from their Nebraska taxable income each year 5000 if married filing. Arkansas Taxpayers who contribute to an Arkansas plan can deduct up to 5000 or 10000 total for a married couple from their Arkansas adjusted gross income for. If 2022 is the year that you.

What happens if not all the money in a 529 is used for college. The student loan interest deduction allows a tax break of up to 2500 for interest payments on loans for higher education. The ONLY FDIC-insured 529.

Never are 529 contributions tax deductible on the federal level. The Path2College 529 Plan operated under the Georgia Office of the State Treasurer gives you a way to start saving today to prepare for a childs tomorrow. The plans are sponsored by states state agencies or.

There are any number of reasons to love 529 plans as a college savings option such as the lack of federal income tax and the flexibility to add or invest money how you see fit but some. The Maryland 529 plan tax deduction is a Maryland state tax deduction you can receive for money you contribute to your Maryland 529 college plan savings and prepaid in a. Never Too Late To Start Saving.

One benefit of using your own states plan however is that you could get a full or partial state tax deduction on your contributions if your state offers that benefit. However some states may consider 529 contributions tax deductible. National College Savings Month highlights the importance of saving now for that education to help your family create opportunities for tomorrow.

Protects your principal and guarantees an annual rate of return of 179 for calendar year 2022 net of all fees. Yes grandparents can claim the deduction for contributing to a 529 if they live in one of the 34 states that offer a state income tax deduction for 529 college-savings plan. VT529 Vermonts official 529 savings plan.

A 529 plan is an excellent option to start saving for your childs college education early. You may not be eligible for such home state deductions or credits by investing in NextGen 529. There are no federal tax deductions for contributions to 529 plans.

For the 2022 tax year the maximum deduction is 3560 per year per beneficiary for marriedjoint filers 1780 for married filing separate status and divorced parents of a beneficiary. Save more with state income tax deductions. Affording College Using Your 529 Saving for College with a 529 Plan.

The tax-free growth and potential tax.

Waasset Com Wp Content Uploads Education Savings P

Why 529 College Savings Plans Are Still Worthwhile Los Angeles Times

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Plan Details Information Scholarshare 529

529 Savings Plan Secure The Future Best College Savings Plans Inside How To Plan College Savings Plans 529 College Savings Plan

What Are The 529 Plan Contribution Limits For 2022 Smartasset

Learn About Ohio 529 Plan Collegeadvantage

Determining How Much To Contribute To A 529 Plan Not Too Much

Determining How Much To Contribute To A 529 Plan Not Too Much

Features Benefits Maryland 529

Tax Benefits Nest Advisor 529 College Savings Plan

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

Michael W Frerichs Illinois State Treasurer College Savings

Benefits Of Using A 529 College Savings Plan Sofi