rsu tax rate calculator

If your company gives you an RSU you dont actually receive company stock. Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns.

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

IRS Form 1099-NEC for nonemployees.

. Easily calculate your tax rate to make smart financial decisions Get started. Discount Rate is the interest rate that the Federal Reserve Bank charges to the depository institutions and to commercial banks on its overnight loans. It is set by the Federal Reserve Bank not determined by the market rate of interest.

Sale of shares if listed. Tax rate-25 interest rate-5 debt-20000 Diluted EPS Formula Net IncomeBefore Preferred DividendsAfter Tax Cost of Interest Common Shares Outstanding Additional Shares Against Exercise of Convertible Securities. Income tax slab rate.

The 22 flat rate could result in too little being withheld for taxes depending on your tax bracket. Tax 15 x 20 shares x Rs250 - Rs170 240 and 3 cess on it. Use of RSU time based or performance based income Use of short term rental income reflected on tax returns ACE eligible on conforming High Bal FHLMC Standard programs.

Taxable amount Sale Price on date of sale less FMV on exercise date. 115-97 made a change in the law that allows a new election for qualified employees of private corporations to elect to defer income taxation for up to 5 years from the date of vesting on qualified stock granted in connection with broad-based compensatory stock option and restricted stock unit RSU programs. Everything under a certain amount is taxed at one percentage and everything over is at the other.

You pay tax on this amount at your highest marginal tax rate but you get to keep the remainder. 15 on short term capital gains. The circle rates are fixed by the state government or the local development authority.

View the investor calendar or manage shares here. Under Income from Salary. Tax 30 x 100 shares x Rs 170 - Rs 100 Rs 2100 and 3 cess on it.

Employers withhold at a flat rate of 22 on the first 1 million of supplemental wages paid out during the calendar year. Notice that a slider is only produced for p as the value of q is fixed. Expose internal modules dom functions.

Circle rates mean the minimum rate of property that is prescribed for a particular area. The AMT tax bracket functions just like the regular income tax brackets in that it is marginal tax but much simpler. Lets calculate our the Alternative Minimum Tax we may owe.

RSU of MNC perquisite tax Capital gains ITR eTrade covers RSU in detail. The Pushpay Investor Center has current share price key metrics and announcement reports. An interest rate is an amount charged by a lender to a borrower for the use of assets.

On this page is a Restricted Stock Unit Projection calculator or RSU calculator. From there the RSU projection tool will model the total economic value of your grant over the years. What is Range Slider With Fixed Values.

Tuition waivers sometimes referred to as nonresident tuition exemptions allow out-of-state students to pay tuition at in-state ratesThese. Schedule 1 Line 8z. Suppose Indian resident got RSU listed in US stockSupose he got Dividend income 100 USDUS govt will deduct 25 tax so 75USD as dividend will be there only now For that US govt will issue form 1042-S Now in India we file form 67 showing 100USD income let say 7500 and claim credit of 25USD tax deducted in US.

Capital Gain Calculator from FY 2017-18 with CII from 2001-2002. Once supplemental wages for the year exceed 1 million employers withhold at a flat rate of 37. Rather you receive units that will be exchanged for actual stock at some future date.

You could then turn around and sell the shares on the open market for 100 per share. This leaves you an immediate economic gain of over 600 per quarter or about 2400 per year. There are only 2 tax rates.

Must get ACE with LP recommendation Intended for approved Mortgage Brokers use only and not for consumer use or for public distribution. A restricted stock unit is a substitute for an actual stock grant. For employees tax withholding occurs at NQSO exercise or restricted stockRSU vesting and the income should appear on Form W-2.

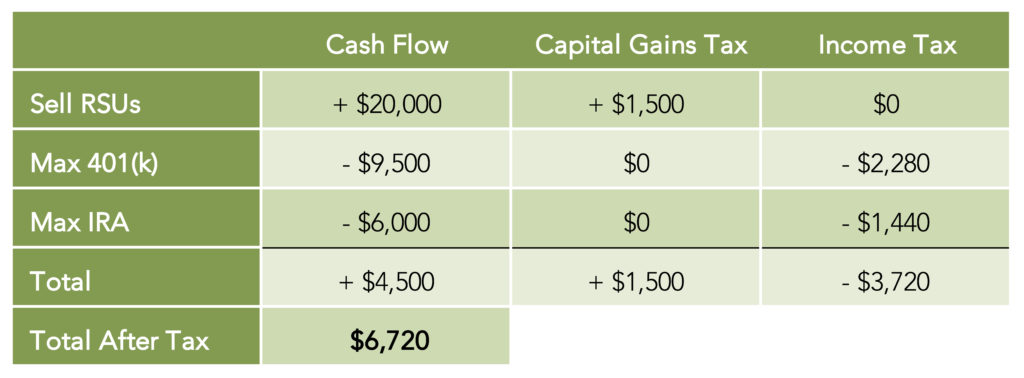

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Equity Compensation 101 Rsus Restricted Stock Units

When Do I Owe Taxes On Rsus Equity Ftw

Rsu Calculator Projecting Your Grant S Future Value

Restricted Stock Units Jane Financial

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Salary Requirements Types Of Taxes